Effie Zahos is certainly one of Australia’s main private finance commentators with greater than 20 years of expertise in shopper finance subjects, together with banking, finance and property. She has a knack for being profitable issues easy. Effie shares her prime funds suggestions and monetary recommendation to get finance match with The Wholesome Mummy.

It’s by no means been a costlier time to dwell! With one other rate of interest rise for mortgage holders, a rental disaster and costly petrol, electrical energy and meals, it truly is a time for some sensible monetary prime suggestions.

As the price of dwelling continues to rise, inflationary pressures are anticipated to persist for a while. Aussies at the moment are on the lookout for methods to take again management. The excellent news is that with a bit of planning, you possibly can. Because the saying goes, ‘you possibly can’t management the wind, however you possibly can modify your sails.’ And the perfect software you could have in relation to adjusting your sails is the common-or-garden family funds. No person actually teaches you tips on how to construct a funds not to mention handle one.

It’s anticipated that you simply simply know tips on how to do it. I truly cowl the fundamentals of budgeting in my e book From Converse to Louboutins: A Actual Lady’s Information to Cash. First, you might want to look backwards earlier than you possibly can transfer ahead. Print out your on-line financial institution statements and spotlight your bills.

What you’re on the lookout for right here is:

- Did you overspend in some classes?

- Do you might want to evaluation a few of your family payments?

- Is your spending according to your objectives?

- Do you could have too many discretionary “faucet and go” purchases?

This could offer you a good suggestion as to the place your cash goes. From right here, you’ll be capable of group your prices right into a method.

Set your method

There’s no scarcity of formulation that will help you handle your funds, together with paying your payments on time and with the ability to take these much-needed holidays. A preferred possibility is the 70:20:10 plan. Right here’s the way it works. Divide your cash between:

- 70% for on a regular basis dwelling prices (lease or residence mortgage, transport, clothes, meals and utilities).

- 20% for saving (don’t skimp on financial savings)

- 10% for splurging.

Subsequent, arrange some buckets. As a substitute of lumping your “on a regular basis dwelling” bills right into a single bucket, as an example, open a number of buckets (accounts) and provides every of them a nickname. You may need one account for varsity charges, one other for family payments and so forth. The identical goes for financial savings. The 20% may be additional damaged down between financial savings buckets – 5% can go to your wet day bucket, 10% to your vacation bucket and 5% to the “get forward” bucket.

Utilizing buckets inside buckets makes it simpler to attain a number of objectives. You possibly can allocate a set sum to every bucket, monitor your progress and fine-tune your funds for every goal. Select fee-free on-line financial savings accounts with a wholesome ongoing price relatively than a short-lived introductory price, and you’ll’t lose.

Can you narrow prices?

Chances are high, there’s a handful of common payments gorging down your pay packet. Have been you responsible of including on a couple of too many streaming providers throughout lockdown? Possibly you possibly can take a look at whether or not or not you may get a greater deal, or perhaps give a selected service the flick.

There are lots of easy steps you possibly can take to scale back your bills. Huge ticket objects like your own home mortgage are the place the massive financial savings are, however even small financial savings can add up.

Are you able to earn extra?

Don’t neglect your earnings. In relation to making additional money, the sharing economic system gives loads of alternatives. You may determine to lease out your spare room, share your automobile or pet-sit to spice up the cash coming in.

Love thy Tremendous

There’s a massive hole between the superannuation financial savings of Australian women and men. Given that ladies are inclined to dwell longer it’s much more necessary for us to verify we now have a comfortable retirement. One option to learn the way you’re monitoring is to make use of the net Tremendous Stability Detective on the SuperGuru web site.

Enter your date of delivery, and the calculator exhibits how a lot you want in tremendous at the moment to achieve the ASFA Comfy Commonplace steadiness by age 67. It exhibits {that a} 35-year-old ought to at the moment have about $93,000 in tremendous.

In any other case, bounce onto the Retirement Planner on the MoneySmart web site. It exhibits you’re doubtless earnings in retirement primarily based in your tremendous steadiness plus any Age Pension funds. Whichever possibility you employ, in case your steadiness appears a bit of lean, it’s by no means too late to develop your tremendous by means of wage sacrifice, voluntary contributions or authorities co-contributions. It could make an incredible distinction.

Let’s say a lady aged 35 earns $50,000 yearly and has the common tremendous steadiness for a girl her age of $69,300. By including simply $1 additional to her tremendous every day – that’s $30 a month, and she will be able to accumulate an extra $148,389 in tremendous by age 67.

Head to Moneysmart’s on-line tremendous calculator to see how a couple of additional {dollars} added to your tremendous could make a distinction.

There are methods you possibly can enhance your tremendous even if you happen to’re not working. Cashback websites like Tremendous-Rewards pay you cashback straight into your tremendous fund simply by purchasing on their platform.

Easy methods to save $580 per 30 days

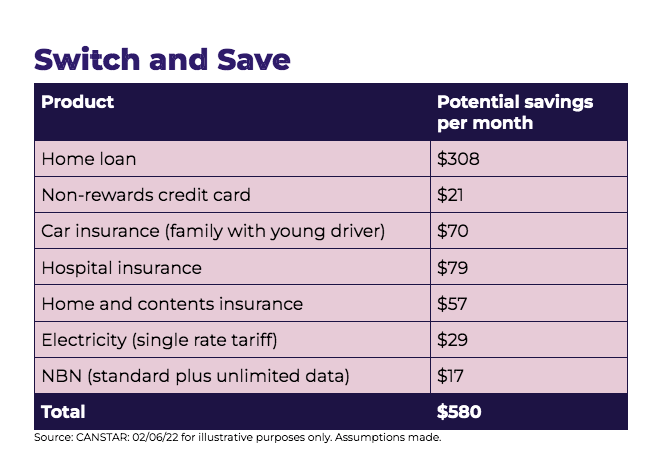

One of many best methods to claw again some financial savings is to check out your common family payments – you can save as a lot as $580 per week by switching from common funds to the most cost effective available in the market. While the most cost effective might not at all times be the perfect it does offer you a good suggestion of how a lot financial savings may be made by repeatedly reviewing your family payments.

High funds suggestions and cash guidelines to dwell by:

It’s not what you earn that counts; it’s what you spend!

While you get a pay rise, generally it’s a case of the extra you earn, the extra you spend, which then leads us to spend extra on services, in flip forcing us to earn much more. It’s a vicious cycle that almost all of us don’t even realise we’re in.

Detox your funds

Similar to an organised residence has a spot for every thing, so ought to each greenback you earn. The bucket system is a straightforward technique to assist tidy up your funds. There’s no scarcity of funds formulation to observe, and a well-liked possibility is the 70:20:10 plan. One other is the 60:40 funds plan.

Set your financial savings to autopilot

Pay your self first. Arrange common computerized direct debits out of your on a regular basis account into your financial savings. Time the transfers to coincide with paydays. At all times deal with financial savings as a invoice – it can’t be missed!

Budgets aren’t set in stone

Some folks don’t funds and are financially profitable, whereas others watch each cent but, due to their circumstances, proceed to dwell from pay to pay. Should you’re going to do a funds, you’ve acquired to be sincere with your self about all these hairdresser appointments. There’s no level in making a funds that doesn’t replicate your life.

If you’ll observe a funds, it’s necessary you could have an emergency fund hooked up to it. In any other case, you set your self up for failure.

Work out what makes you tick

Why are some folks higher savers than others? How do advertisers trick us with “mid-priced” choices? Understanding your monetary psychology may prevent cash. Take the time to seek out out why you do what you do.

Don’t spend mindlessly

Sleep on all impulse purchases for at the very least one evening.

Establish your monetary stressors and make a plan

Strive to not overwhelm your self. Make an inventory of all the cash woes you’re having and concentrate on managing one subject at a time in order to not grow to be overwhelmed.

Preserve collectors within the loop

Name your collectors if you’re experiencing monetary hardship and allow them to understand how you propose to sort out the problems. Many firms have hardship officers who can assess your state of affairs and work out what assist and technique is offered.

Construct a money cushion

A money cushion is finance strictly for emergencies solely. Assume the lack of a job, medical sickness or an sudden monetary curveball.

The thought is you find the money for in your cushion account to not solely deal with the disaster however, within the occasion of a job loss, cowl your absolute necessities (meals, shelter, clothes – designer sneakers don’t depend) till you discover a job once more. It’s best to purpose to have a couple of thousand {dollars} in there to help you thru this era.

It could take some time to construct up a cushion account, and in case you have a mortgage, it could pay to maintain your financial savings there. For instance, you could have a $400,000 mortgage at 3.37%, and you’ll afford to save lots of $50 per week. Popping this into your own home mortgage’s redraw or offset facility, you’ll not solely have $36,000 within the account after 15 years, however in line with Canstar evaluation, you’ll save round $10,700 in curiosity on your own home mortgage.

Search assist

Should you don’t know the place to begin, name the free Nationwide Debt Helpline on 1800 007 007. Nationwide Debt Helpline is a not-for-profit service that helps folks sort out their debt issues. We’re not a lender, and we don’t ‘promote’ something or become profitable from you. Our skilled monetary counsellors provide a free, impartial and confidential service.

For extra nice household funds suggestions, take a look at The Wholesome Mummy Funds Hub your go-to for budget-friendly suggestions, methods and gives from The Wholesome Mummy Funds Squad.